Identify Trend

Part 1: Identifying the Long-Term Fundamental Trend

The first step in the system is to determine the long-term fundamental trend for any currency. This trend is crucial because it helps us understand when major movements began and ended.

Key Point:

- The long-term movement of a currency is often driven by government policies. Once you know what to look for, these trends become easy to spot.

How to Identify the Long-Term Trend:

- Secret 1: You can only find the long-term trend on the monthly chart, and we’ll use technical analysis to spot it.

Technical Indicator:

- We use a 2-period Moving Average (2MA) set to open on the monthly chart. This gives us a clear visual of the trend.

Example of Long-Term Trends in Major Currencies

Let’s look at two major currency pairs and how their fundamental trends changed over time:

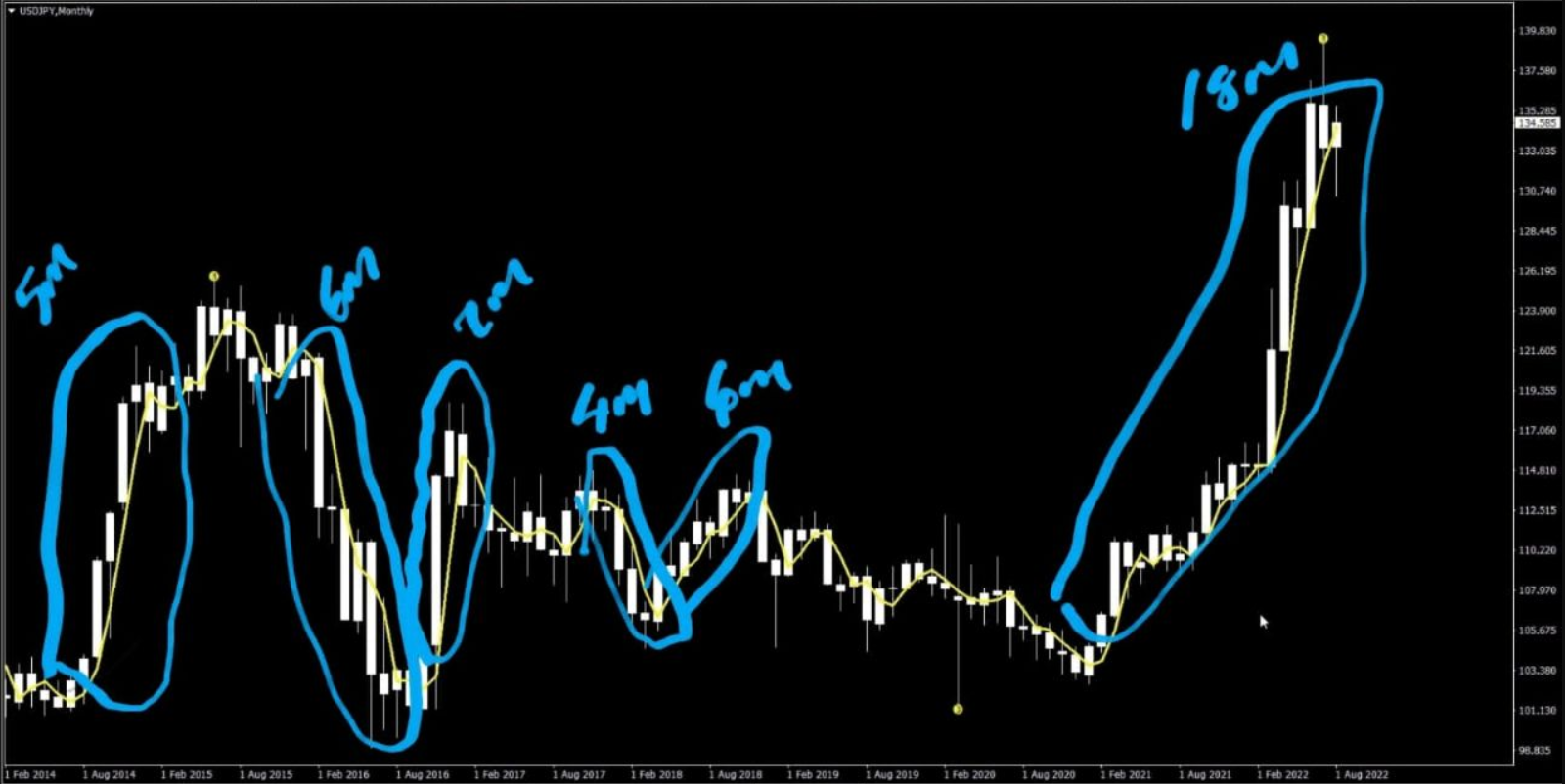

- USD/JPY (2014-2022): The fundamental trend changed direction 6 times over 8 years.

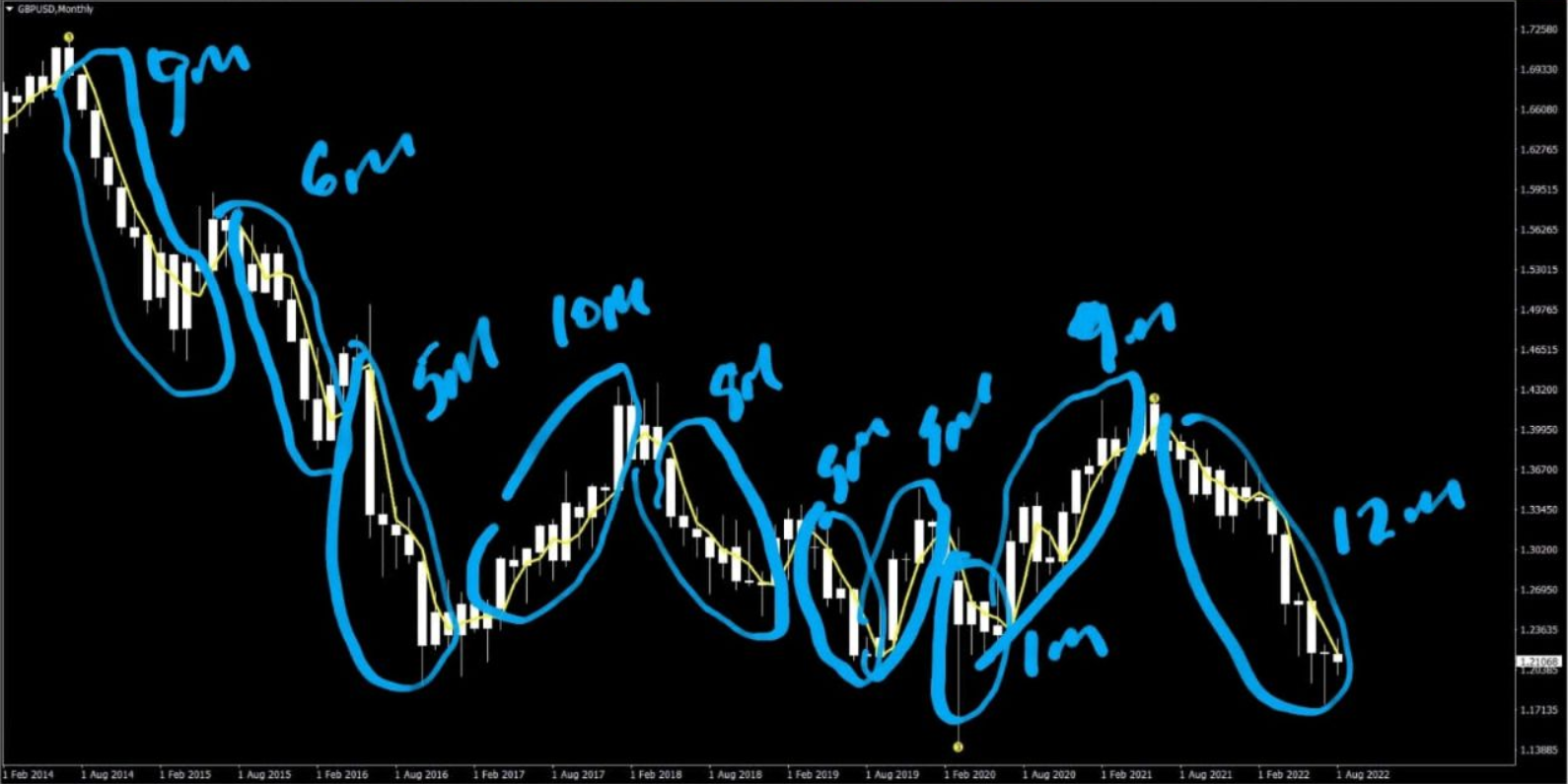

- GBP/USD (2014-2022): The fundamental trend changed direction 7 times over 8 years.

Observation:

In the examples, notice the yellow line on the charts, which represents the 2MA. This line helps us track the long-term trend.

Part 2: Trading on Lower Time Frames

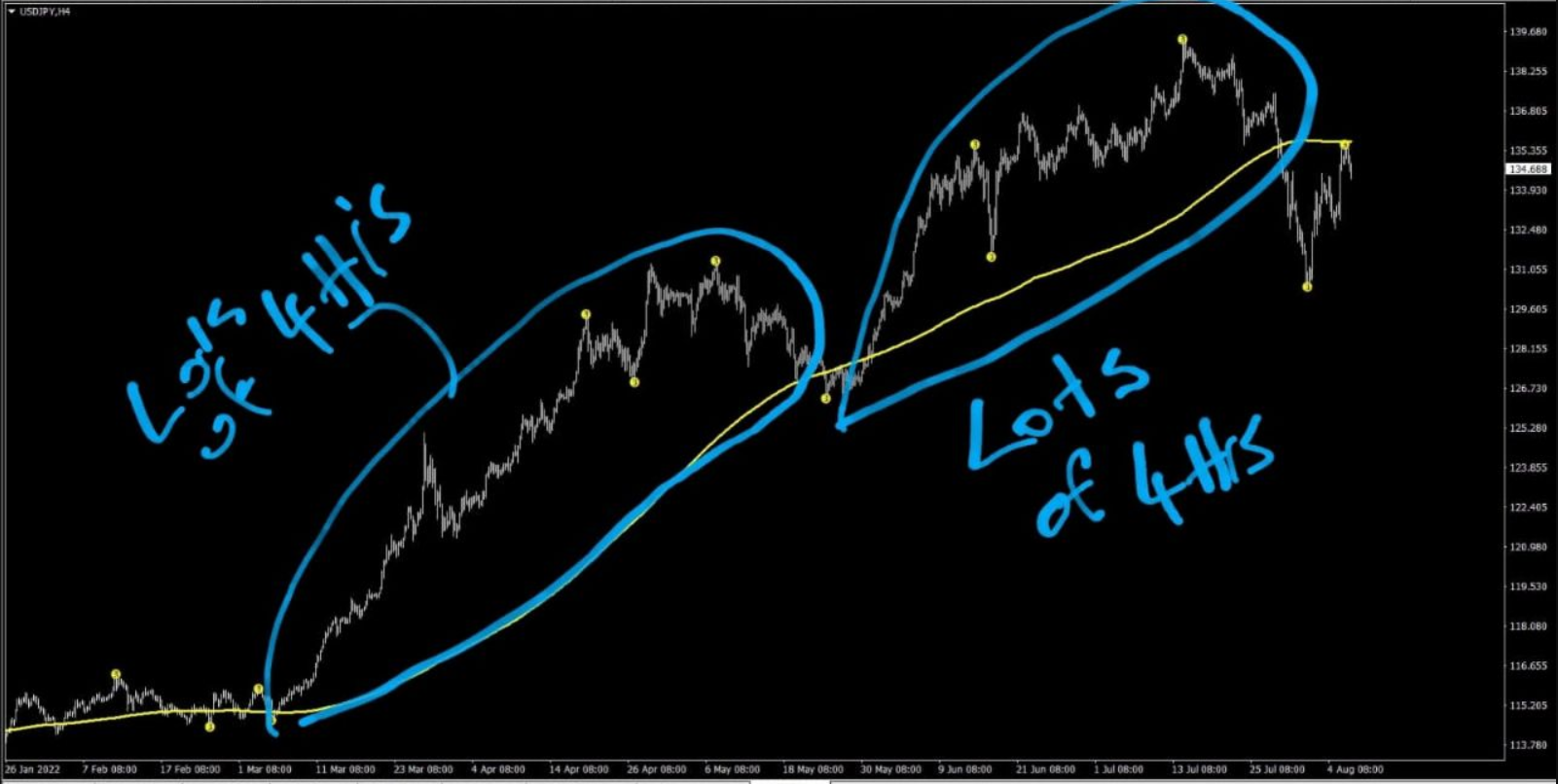

Once we’ve identified the long-term trend, the next step is to trade on a lower time frame, specifically the 4-hour chart.

Mathematical Breakdown:

To convert the 2MA on the monthly chart to lower time frames, we use basic math:

- Monthly to Weekly:

- 2MA (monthly) × 4 weeks = 8MA on the weekly chart.

- Weekly to Daily:

- 8MA (weekly) × 5 days = 40MA on the daily chart.

- Daily to 4-Hour:

- 40MA (daily) × 6 (4-hour candles per day) = 240MA on the 4-hour chart.

Example: USD/JPY

Let’s apply this to the USD/JPY:

- From 2014 to 2022, the USD/JPY experienced an 18-month run.

Now, we’ll look at the weekly, daily, and 4-hour charts for further insights.

weekly charts

weekly charts

daily charts

daily charts

4-hour charts

4-hour charts

Part 3: The Trading Rule

The trading rule is simple and effective:

- BUY above the 240MA line.

- SELL below the **240MA line.

This approach allows us to align with institutional investors, banks, and government actions while ignoring the noise that affects 99% of retail traders.

Why This Strategy Works

By following this system, we’re not trading based on news or speculation. Instead, we’re aligning with the movements of institutional banks and governments, which truly drive the forex market. Let retail traders chase news while we follow the smart money.

A Personal Note

I’ve personally invested over $15,000 to learn what I’m sharing with you today. While others might charge for this knowledge, I’m here to help you succeed.

And remember, this is just the first part of the system—there’s a lot more to come!